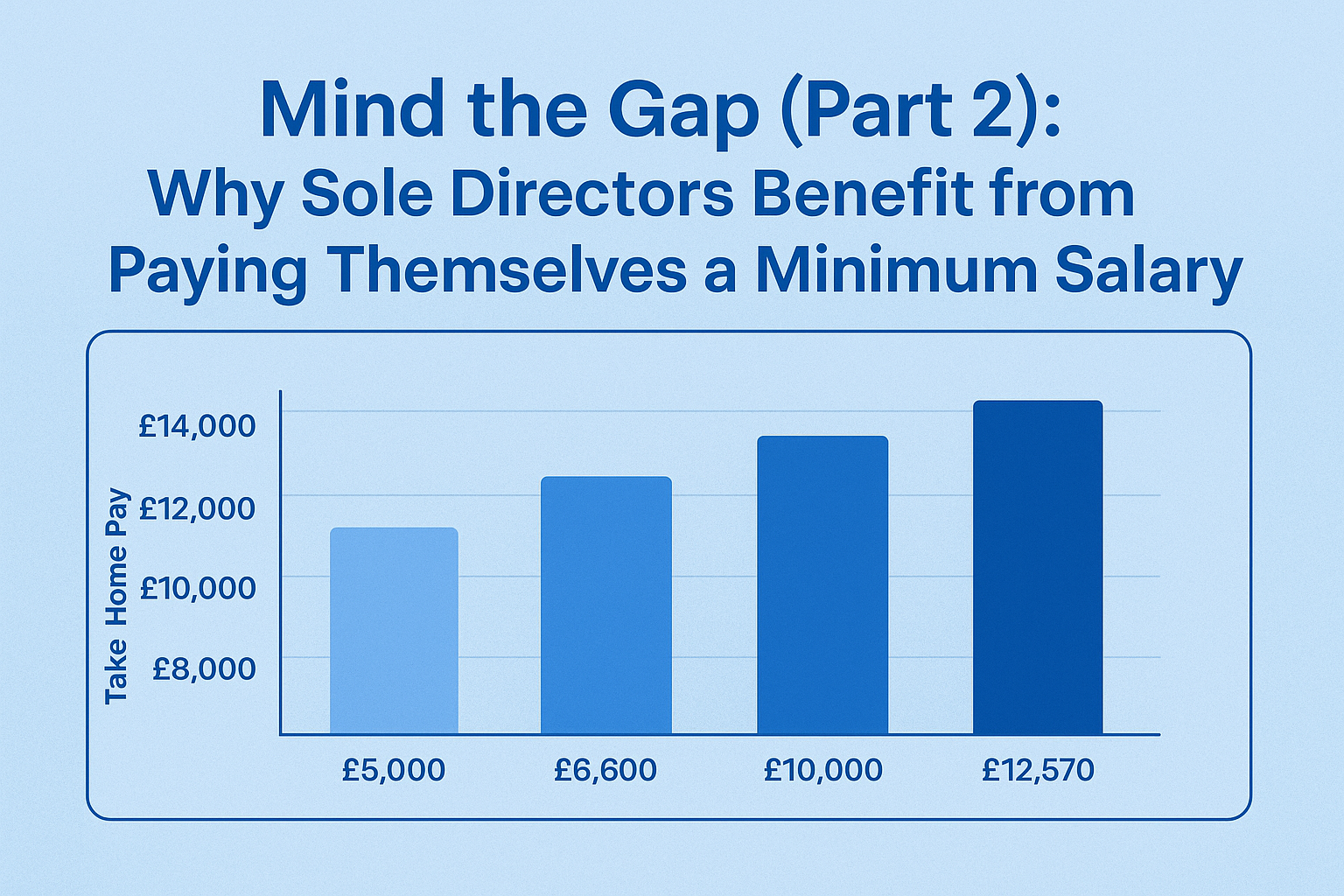

Mind the Gap (Part 2): Why Sole Directors Benefit from Paying Themselves a Minimum Salary

In my previous article “Mind the Gap”, I highlighted the common pitfalls small business owners face when structuring their income. Let’s now look at the practical impact for sole directors without employees – and why it often makes sense to take a minimum wage salary, even if it means paying some National Insurance.